Alberto Cavallo and Oleksiy Kryvtsov

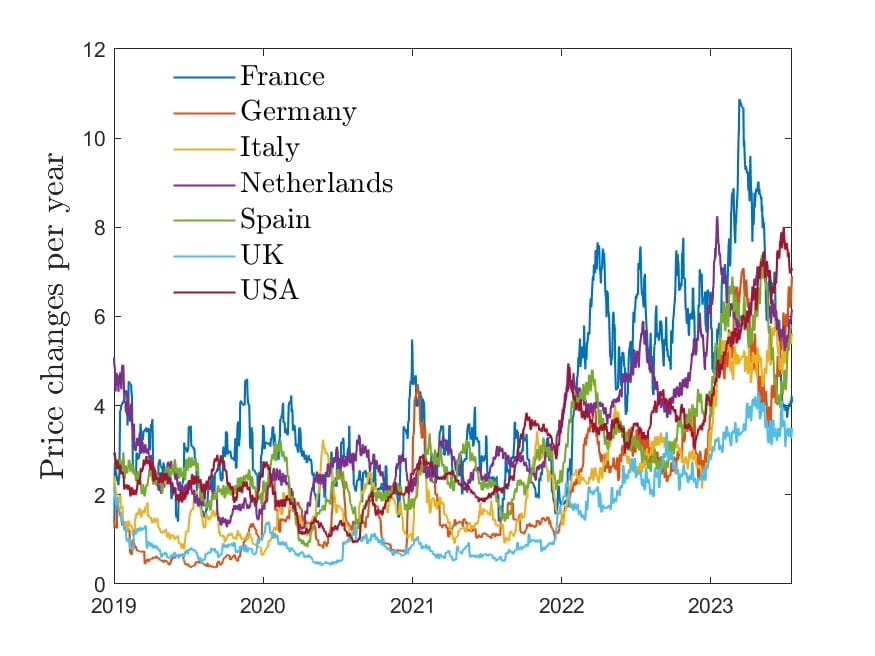

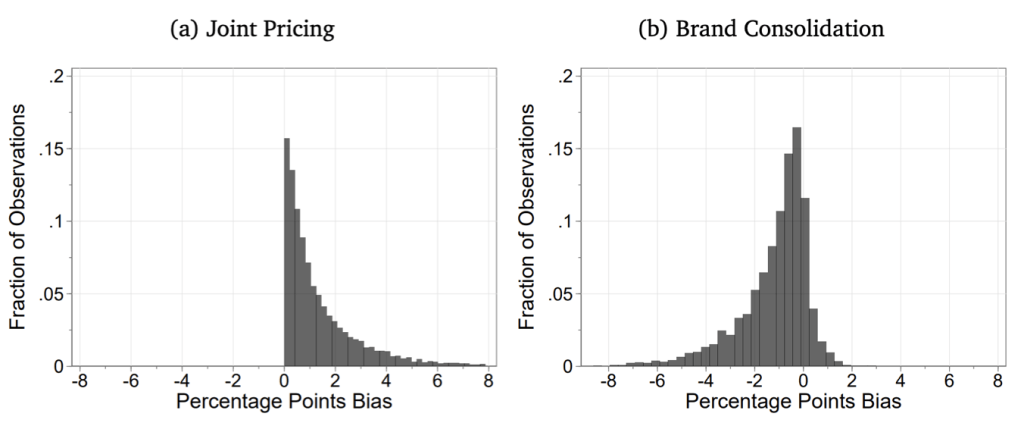

We study how within-store price variation changes with inflation, and whether households exploit it to attenuate the inflation burden. We use micro price data for food products sold by 91 large multi-channel retailers in ten countries between 2018 and 2024. Measuring unit prices within narrowly defined product categories, we analyze two key sources of variation in prices within a store: temporary price discounts and differences across similar products. Price changes associated with discounts grew at a much lower average rate than regular prices, helping to mitigate the inflation burden. By contrast, cheapflation—a faster rise in prices of cheaper goods relative to prices of more expensive varieties of the same good—exacerbated it. Using Canadian Homescan Panel Data, we estimate that spending on discounts reduced the change in the average unit price by 4.1 percentage points, but expenditure switching to cheaper brands raised it by 2.8 percentage points….