HBS Pricing Lab

We study firm-level pricing decisions and capabilities to understand their micro and macroeconomic impacts.

Our lab collaborates with companies who share access to their proprietary datasets to obtain insights

on firm performance and the broader economic environment.

We are part of the Digital Data Design Institute at Harvard.

Current Projects

Cost-Passthrough and Retail Markups

Santiago Alvarez-Blaser, Alberto Cavallo, Alex Mackay and Paolo Mengano

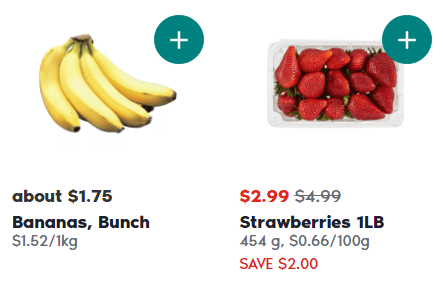

Retail Price Discounts and the

Post-Pandemic Inflation Surge:

Evidence from Online Micro Data

Alberto Cavallo and Oleksiy Kryvtsov

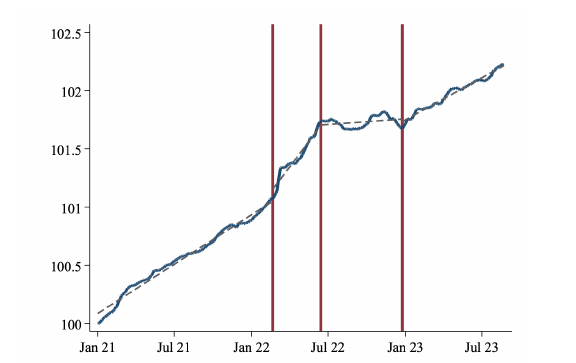

Detecting Turning Points in Inflation:

A Structural Breaks Approach

Alberto Cavallo and Gaston Garcia Zavaleta

Our Team

Alberto Cavallo

Founder & Principal Investigator

Alexander MacKay

Founder & Principal Investigator

Paolo Mengano

Post-Doctoral Fellow

Michael Sullivan

Post-Doctoral Fellow

Santiago Alvarez-Blaser

Collaborator

Tomas Pacheco

Pre-doc Research Assistant

Gaston Garcia-Zavaleta

Post-Doctoral Fellow

Peter Nicolajsen

Research Manager

Latest Working Papers

- Large Shocks Travel Fast

Alberto Cavallo, Francesco Lippi and Ken Miyahara

Alberto Cavallo, Francesco Lippi and Ken Miyahara

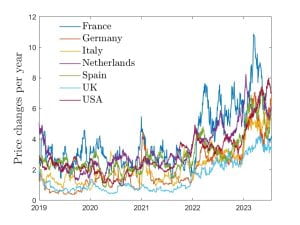

We leverage the inflation upswing of 2022 and various granular datasets to identify robust price-setting patterns following a large supply shock. We show that the frequency of price changes increases dramatically after a large shock. We set up a parsimonious New Keynesian model and calibrate it to fit the steady-state data before the shock. The model features a significant component of state-dependent decisions, implying that large cost shocks incite firms to react more swiftly than usual, resulting in a rapid pass-through to prices–large shocks travel fast. Understanding this feature is crucial for interpreting recent inflation dynamics…. - Consumer Inertia and Market Power

Alexander MacKay and Marc Remer

Alexander MacKay and Marc Remer

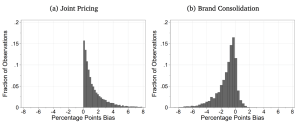

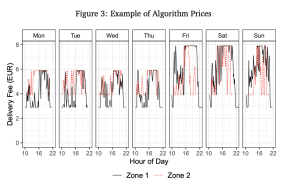

We provide an empirical model to estimate the dynamic pricing incentives generated by consumer inertia (habit formation, search, brand loyalty, and switching costs). We show that these dynamic incentives can limit price increases after a merger, compared to the predictions from a static model…. - Dynamic Pricing and Demand Volatility: Evidence from Restaurant Food Delivery

Alexander MacKay, Dennis Svartbäck and Anders G. Ekholm

Alexander MacKay, Dennis Svartbäck and Anders G. Ekholm

We study the staggered adoption of a dynamic pricing algorithm. We find that high-frequency pricing led to lower prices and lower demand volatility. Our findings indicate that consumers strategically time their purchases, and we highlight how firms can benefit from this strategic behavior through dynamic pricing that results in lower costs….