Large Shocks Travel Fast

Alberto Cavallo, Francesco Lippi and Ken Miyahara

NBER Working Paper 31659

Abstract

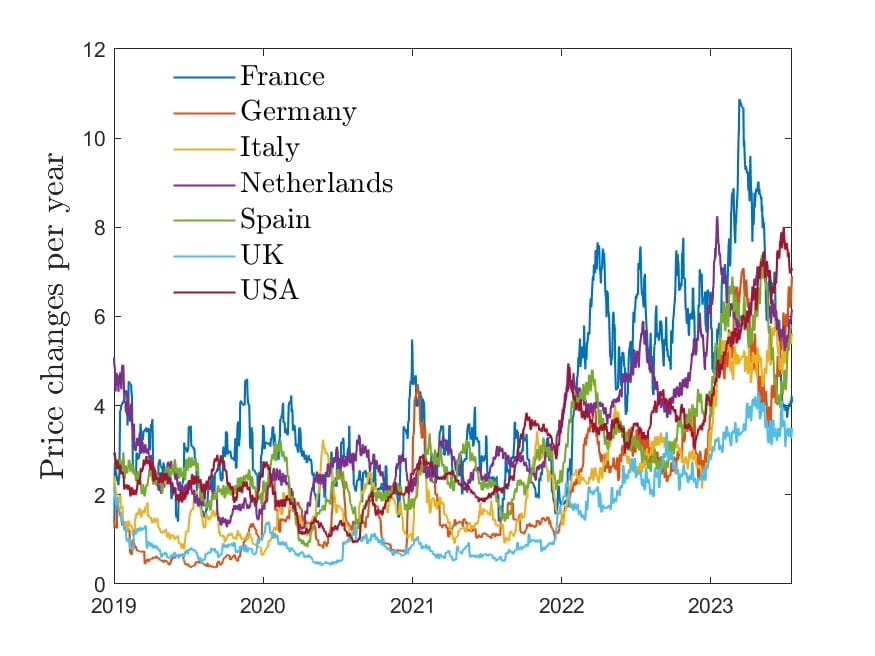

We leverage the inflation upswing of 2022 and various granular datasets to identify robust price-setting patterns following a large supply shock. We show that the frequency of price changes increases dramatically after a large shock. We set up a parsimonious New Keynesian model and calibrate it to fit the steady-state data before the shock. The model features a significant component of state-dependent decisions, implying that large cost shocks incite firms to react more swiftly than usual, resulting in a rapid pass-through to prices–large shocks travel fast. Understanding this feature is crucial for interpreting recent inflation dynamics.

Paper

Online Appendix

Data and Code

Slides