Research

The Firm Life Cycle Origins of the Aggregate Investment Puzzle (JMP)

Abstract

The decline in US investment after the 1980s is puzzling because profits increased and interest rates fell, which should have stimulated investment. I find the decline in the startup rate of new businesses is behind this missing investment boom puzzle. Confidential micro data from the US Census shows a striking divergence between micro and macro trends: investment increased by 10% for the average firm despite a 14.5% decline in aggregate investment. Changes in the firm age distribution masked this investment boom from aggregate data. Fewer births aged firms and depressed aggregate investment because older firms invest less intensely despite being more profitable. In a calibrated firm dynamics model, firm aging due to falling entry explains 80% of the investment trend decline from 11.5% to 9% of GDP between 1980 and 2010. Given historical changes in startup rates, the life cycle model rationalizes the boom and bust in aggregate investment and its puzzling relation with profits and interest rates since the 1950s. Consistent with the model, cross-country data shows rising investment and falling profits amidst a resurgence in startup activity since 2010.

Startups, Intangibles, and the Labor Share

Abstract

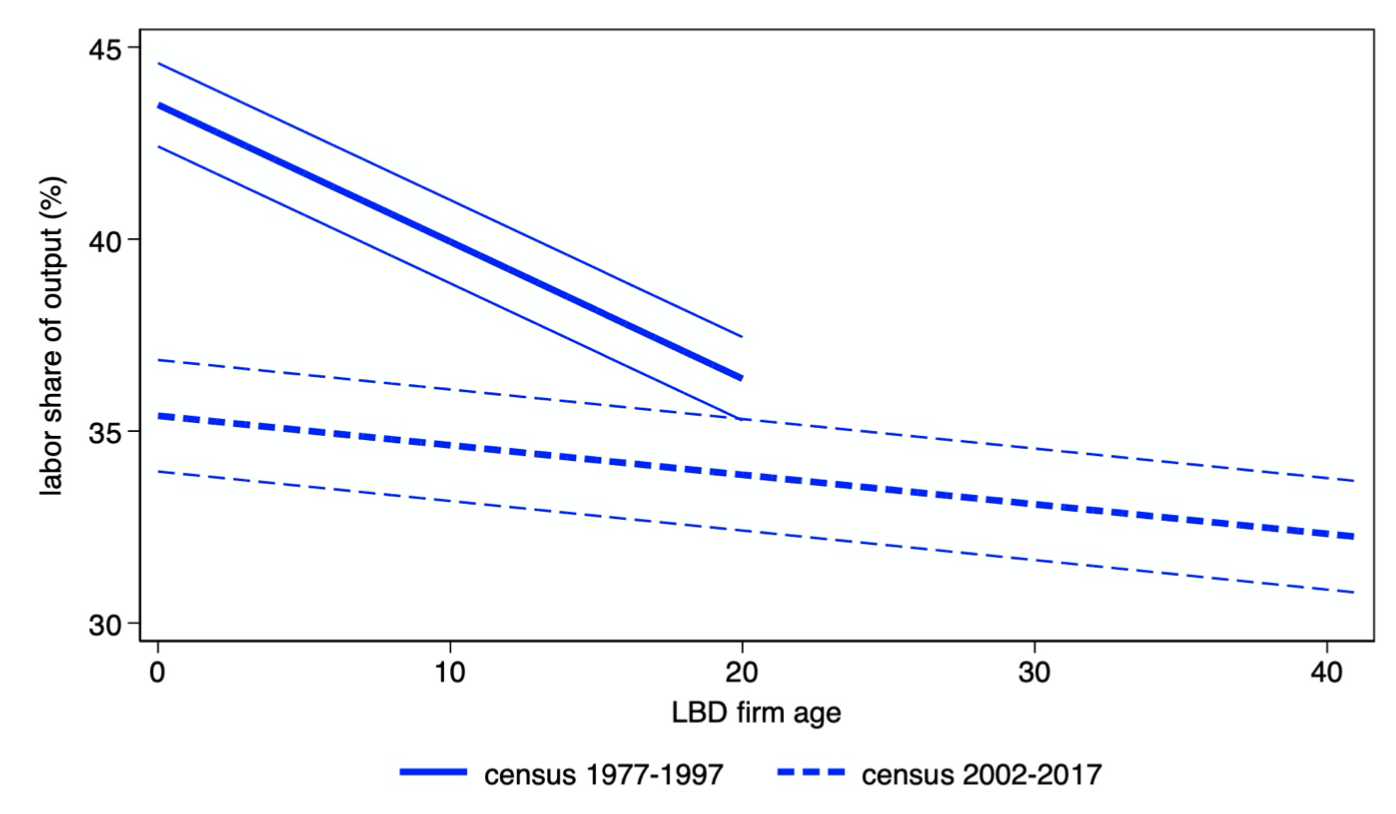

I investigate the firm life cycle origins of the increasing importance of intangible capital investment and the labor share decline since the 1980s using confidential US Census micro data. I find firm aging explains part of these trends: as they grow with age, older firms spend more in advertising or innovation and lower their labor shares. However, the changing composition of startups has been an even more important driver of these trends. Relative to startups in the past, recent cohorts of firms are significantly more likely to invest in intangible capital and survive at higher rates. Younger firms seem to have used intangibles to lower their labor shares rather than substitute for physical capital. These patterns are consistent with a model where information and communication technologies that started to become available after 1980 have increasingly been adopted by firms at the startup stage.

Draft coming soon (results pending Census disclosure)

US Startup Creation and Immigration Policy

Abstract

Immigrants are only 15% of the US population but disproportionately run highly successful startups. Immigration policies aimed at restricting foreign labor supply may end up reducing labor demand by lowering firm creation. Real time survey evidence around a 2020 student visa policy announcement shows increasing immigration barriers can indeed lower startup creation among highly educated immigrants. Financial constraints amplify the negative effects of immigration policy shocks on startup creation. A model where immigrants face policy and financial hurdles predicts liberalizing immigration can have positive aggregate effects by increasing firm entry and improving talent allocation. Thus, immigration liberalization policies could help advanced economies facing declining startup rates since the 1980s due to slowing population growth.

Draft coming soon. See related Crimson article

The Firm Age Anatomy of the US Economy in the Post War Era

Abstract

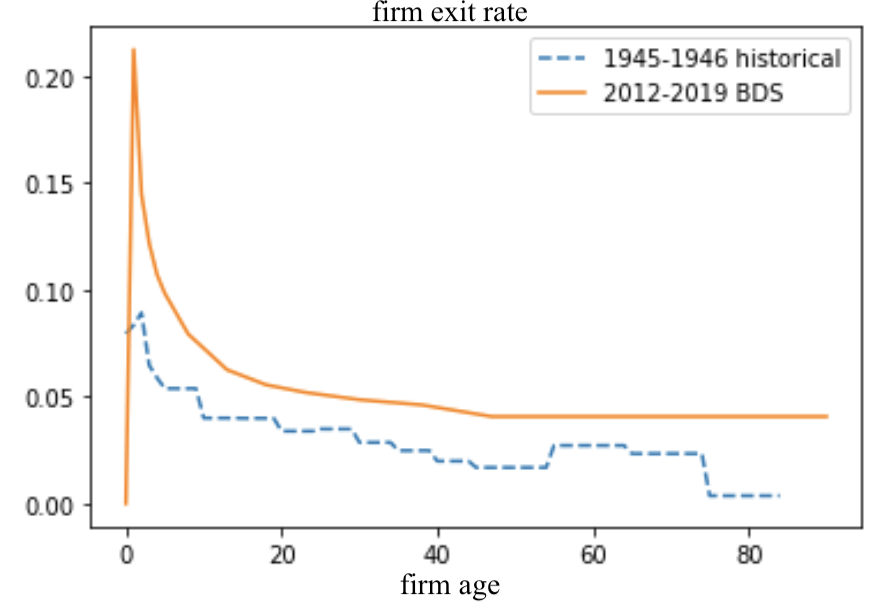

The full age distribution of firms in America is unknown since the US Census does not track firms’ date of incorporation: age can only be known after 1977. In this paper, I digitized historical data on the US firm age distribution right after WWII. I document that the 2020 firm age distribution is remarkably similar to the one in 1950, suggesting the decline in entry after 1977 may have been bringing the economy back to a 1950 steady state. However, I show that firms today exit systematically at higher rates and experience faster growth throughout their life, suggesting US firms today are better selected than those in 1950. Finally, I compare the US to other OECD countries, showing that the recent resurgence in startup activity in Census data since the Great Recession—ending four decades of decline—may be having more pronounced aggregate consequences in the US than in less advanced economies.

Teaching

Ludwig Straub’s Heterogenous-Agent Macroeconomics

Content

2nd year Ph.D. course on business cycle theories with heterogeneous agents tailored to data on inequality (e.g. “HANK”)

See syllabus and my section materials

Philippe Aghion’s Innovation, Firm Dynamics, and Economic Growth

Content

2nd year Ph.D. course covering frontier Schumpeterian innovation-based theories of economic growth matching firm dynamics data

See syllabus and my section materials

Robert Barro’s Macroeconomic Theory: Economic Growth

Content

Core 1st year Ph.D. course in economic growth, covering neoclassical and endogenous growth, misallocation, asset pricing, and public debt.

See syllabus and my section materials