The Firm Life Cycle Origins of the Aggregate Investment Puzzle

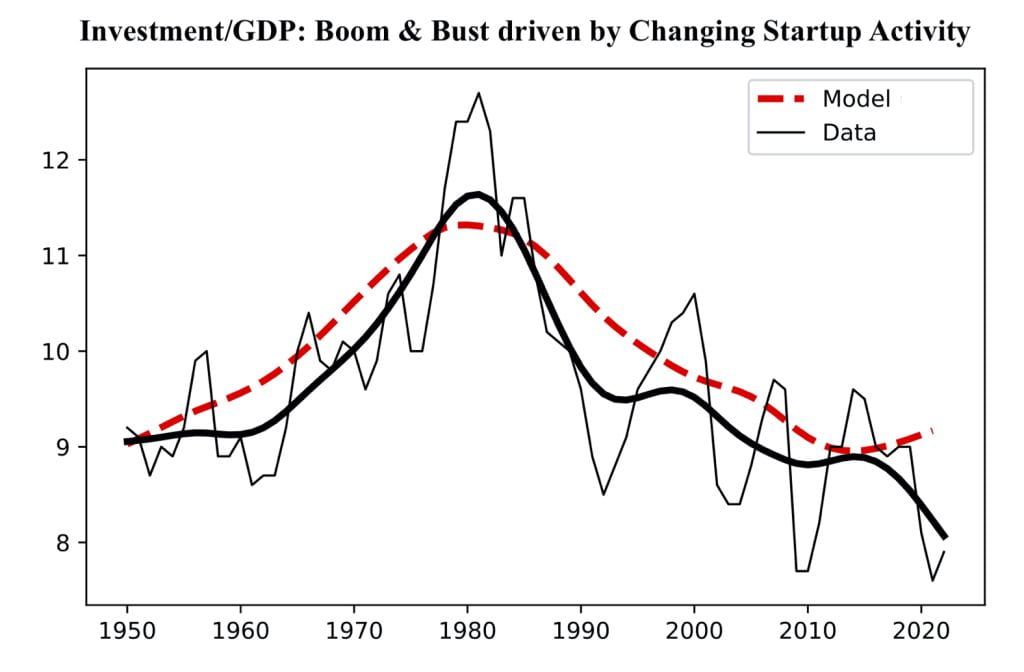

The decline in US investment after the 1980s is puzzling because profits increased and interest rates fell, which should have stimulated investment. I find the decline in the startup rate of new businesses is behind this missing investment boom puzzle. Confidential micro data from the US Census shows a striking divergence between micro and macro trends: investment increased by 10% for the average firm despite a 14.5% decline in aggregate investment. Changes in the firm age distribution masked this investment boom from aggregate data. Fewer births aged firms and depressed aggregate investment because older firms invest less intensely despite being more profitable. In a calibrated firm dynamics model, firm aging due to falling entry explains 80% of the investment trend decline from 11.5% to 9% of GDP between 1980 and 2010. Given historical changes in startup rates, the life cycle model rationalizes the boom and bust in aggregate investment and its puzzling relation with profits and interest rates since the 1950s. Consistent with the model, cross-country data shows rising investment and falling profits amidst a resurgence in startup activity since 2010.